What is the First Home Loan Deposit Scheme AND Are You Eligible? 🧐

In a nutshell, the First Home Loan Deposit Scheme will allow eligible first-time buyers to enter the property market sooner, by providing a Government guarantee that will allow first home buyers to purchase a home with a deposit of 5%.

The government will essentially act as a guarantor, securing the remaining deposit to bring the borrower up to 20%.

*Banks usually make borrowers with a deposit of less than 20% of the value of the property they’re buying, pay an insurance to protect themselves if you don’t pay your loan back. This could save you approximately $12,000 – $30,000 (depending on the size of your home loan).

What we know:

✅ There are only 10,000 spots available

✅ Eligibility – Singles earning up to $125,000 and Couples earning up to $200,000 can apply

✅ It will work on a ‘first in best dressed’ basis.

✅ Must have a 5% deposit (the Government will guarantee the remaining 15% so you avoid LMI).

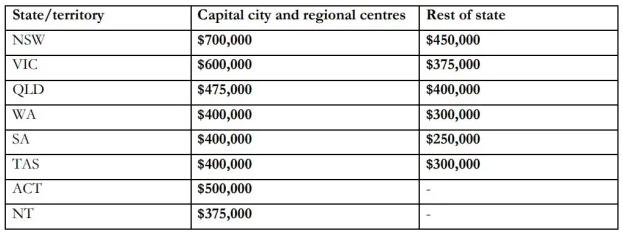

✅ Price thresholds for properties depending on the city and region (see image below).

✅ Starts January 1, 2020.

✅ Borrowers will still have to meet the existing servicing guidelines and credit checks.

✅ The scheme will be administered through the National Housing Finance and Investment Corporation (NHFIC) in partnership with lenders.

What We Don’t Know:

📌 Any of the finer details around how the Governments ‘guarantee’.

📌 Which lenders will offer loans under the scheme (talk that the government may prioritise smaller lenders to help boost competition) and what the interest rates will be.

📌 How to apply and when they will start taking applications?

What Should You Do?

✨ If you want to take advantage of this ‘Scheme’ make sure you meet the eligibility criteria eg. income threshold and have the minimum deposit of 5% already saved.

✨ Not all banks will offer loans under this scheme so keep in close contact with your Mortgage Broker and be ready to apply when applications open (remember, it’s first in best dressed).

✨ Ask yourself, ‘does the type of property I want to buy fall under the price cap?’ (Sydney <700k, Melbourne <600K, Brisbane <475K etc).

✨ If the property you want to buy is above the price cap all is not lost. You can still apply for a home loan with a small 5% deposit (or even less) without the assistance of the scheme, you will just have to pay LMI or possibly use Mum or Dad as a guarantor, so speak to your Mortgage Broker about ALL of your options.

✨ Be mindful that there are only 10,000 spots available (that means 90% of first-time buyers may miss out or won’t be eligible) so think seriously if you’re going to pass up a great deal on a property now, with the hope of receiving assistance via the scheme next year.

✨ Write down the pros and cons of using the scheme. Just because you’re eligible to apply for it, doesn’t necessarily mean it’s your best option.

🏡 Always seek advice from a qualified professional. If you don’t currently have a Mortgage Broker you can speak with, click here to send us a message and we can recommend Mortgage brokers in your State who specialise in helping first-time buyers.